Safe Money

Choosing the right vehicle for your retirement savings can be difficult. With so many choices, which approach is right for you? On one hand, most people want safety — a guarantee for their principal. On the other hand, many prefer the potential of higher returns… but without the risks of an unstable market. Fixed-rate investments cannot offer the potential of market-like returns and stocks and mutual funds carry risks that many people find unacceptable.

Now you can have the best of both worlds; guarantee of principal and the potential of market-linked growth with no risk due to market downturns. An Index Annuity provides you with all of the best features of a traditional fixed annuity: Guarantee Of Principal

Unlike most securities or mutual funds where your account balance can fluctuate due to market performance, premium deposited into an Index Annuity is guaranteed to never go down due to market downturns.

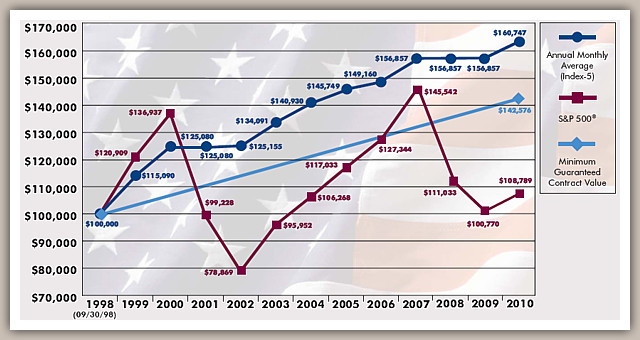

What this graph represents is how an index annuity works. The dark blue line is money invested in an indexed annuity, while the red line is money invested in an S&P 500 mutual fund. In years where the stock market is negative, the index annuity does not decrease in value.